Itemized Receipt: What is it and How to Make it

Generating itemized receipts is now easy with Receiptmakerly. Let's know about itemized receipts and learn the easy process of generating itemized receipts with customizable templates.

4.9 | Made with ♥

What is an itemized receipt?

An itemized receipt is a sales document that includes thorough information on the transaction. It includes an itemized breakdown of the purchase, with distinct lines for each item. It might additionally include the date, time, store name, price, tax, total, and payment method utilized in addition to the items bought. The buyer's account details, the store's return policy, and other information could be included on a receipt with even more specifics.

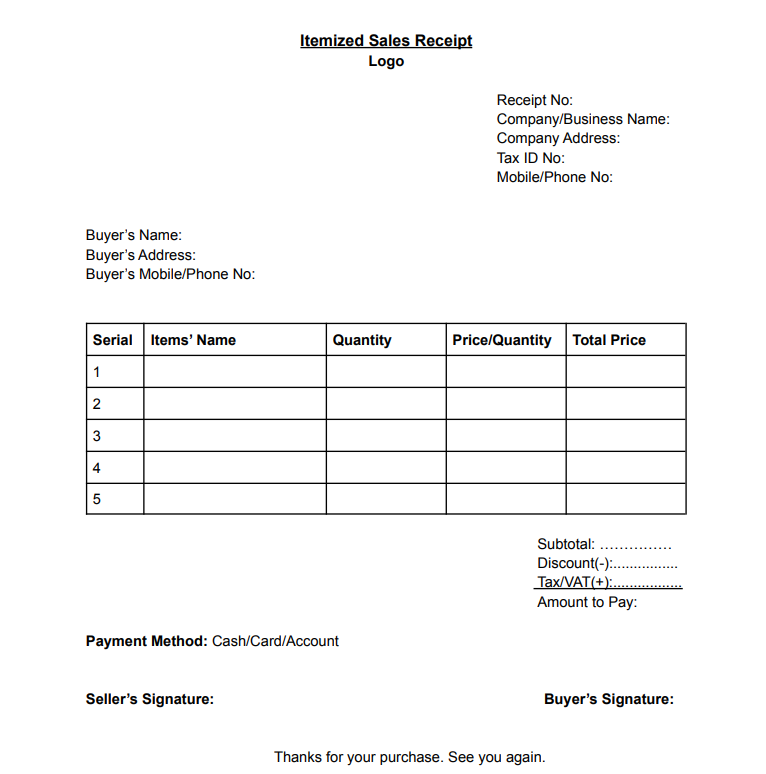

Sample itemized receipt

Remember, an itemized receipt may vary based on the type of business. Below a general itemized receipt sample is added for better understanding.

Components of itemized receipt

An itemized receipt is a combination of both informational and financial data. Different types of itemized receipt are available. It depends on the seller which information they will add in the receipt. But there are some common things that are generally included in the receipt. Let’s look at the components of an ideal itemized receipt with a brief description.

1. Receipt Number

It’s an essential part of an itemized receipt. Receipt number helps the seller to keep better track of the transactions.

2. Date

The date of transaction is a must for an itemized receipt.

3. Seller’s information

An itemized receipt starts with the seller’s information.Following components should be added under seller’s information of an itemized receipt.

- Company name: Based on the type of business it can be Merchant Name, Business Name, Store Name, etc. This name is necessary in the itemized receipt.

- Company address: This address should be detailed enough. It should include the house number, road/street number, zone, postcode,etc.

- Tax ID number: Include the tax id of your business in the itemized receipt.

- Contact details: The easy way to contact you should be added in this part. Add the official phone/mobile number, email address(if there is any), website address.

4. Buyer’s Information

Buyer’s information is also important for an itemized receipt. The information of the buyer that are generally included are:

- Name: It is the name of the person who is purchasing the product(s). It can be the company name if the purchase is made for the company.

- Address: It is the buyer’s address. If a company is a buyer, then the company’s address.

- Contact details: This contact details can be a phone/mobile number, an email address .

5. List of the products

By the name itemized receipt we can understand that the items purchased should be added in the receipt. The seller should add the name of the items sold. If the product category is added, it is even better. Items name should be added serially one after another.

6. Price of the individual items

Every items’ prices need to be added separately against the name in the itemized receipt. Make a serial of the items and write the prices beside the name or in the specific column if there is any.

7. Subtotal

Once you are done with listing all the items with their individual prices, sum up and write the subtotal.

8. Discount/Promotions

If there is any discount, deduct that from the subtotal.

9. Sales Tax

Add the sales tax with the subtotal.

10. Final calculation/Amount to pay

After deducting the discount and adding the sales tax, you get the amount to be paid by the buyer.

11. Payment method

It’s another important part of the itemized receipt. This receipt should include the payment method. It can be cash, card or account transfer. You can write the last few digits of the

11. Seller’s Signature

Seller’s signature with the date is important at the end of the receipt. If you are a seller, do not forget to sign on the receipt.

12. Buyer’s Signature

It is better if the receipt contains the buyer’s signature. If you are a seller, do not forget to take signatures from the buyer.

13. Miscellaneous things you can add

- Logo: It’s not a mandatory thing to add your business logo in the itemized receipt. However, if you add a logo, it will help you to increase the brand reputation and your receipt gets a better look.

- Thank you message: Adding a thank you message at the end of the receipt may increase brand loyalty. It’s also a part of indirect marketing.

Benefits of itemized receipts

1. Helps in transaction tracking

Transaction or expense tracking is important for both sellers and buyers. Sellers get the scope to understand their profitability by storing and analyzing the receipts. Again buyers/customers can also analyze their expenses from the itemized receipts.

2. For reimbursement

It is a normal phenomena of purchasing by ownself for the company you're working for. It is done by employees and managers of different levels. Once you claim for the reimbursement, you need an itemized receipt to show the proof of your transactions. So, do not forget to take the itemized receipt from the seller and check whether the receipt contains the components mentioned above.

3. For decision making

An itemized receipt shows customers what they bought. Seeing where their money went reduces the possibility of payment disputes. Thereceipt lists taxes and other expenses that customers often overlook. This information will help the customers to make decisions while purchasing the same product or service next time.

4. For return and refund

Before accepting returns, many retailers need a POS receipt; if not, they may completely reject the return or restrict it to store credit or an exchange. If you are a purchaser, you should keep the receipts. In case you need to return the product you have purchased.

Usage of Itemized receipts

Itemized receipts are used in different fields. Following are the fields where itemized receipt can be used:

- Restaurant receipts

- Grocery store receipt

- Parking receipt

- Taxi receipt

- Hotel receipt

- Pharmacy receipt

- Auto repair receipt

- Rent receipt

What is the difference between a receipt and an itemized receipt?

As there is a subtle difference between a receipt and an invoice, there are differences between a receipt and an itemized receipt. A general receipt typically just adds the total amount rather than itemizing the purchases. An itemized receipt breaks down the entire purchase, showing customers exactly what they paid for. In an itemized receipt, all the items are listed along with their individual prices. Amount to be paid is calculated at the end of the receipt after deducting the discounts, adding the sales tax with subtotal.

How can I make an itemized receipt ?

You can make itemized receipts manually by using the format shown above You can make itemized receipts manually by using the format shown above or use apps for receipt scanning to keep scanned copies. . However, there are online receipt makers like Receiptmakerly having pre-made templates. You can just input your info and start generating beautiful receipts.